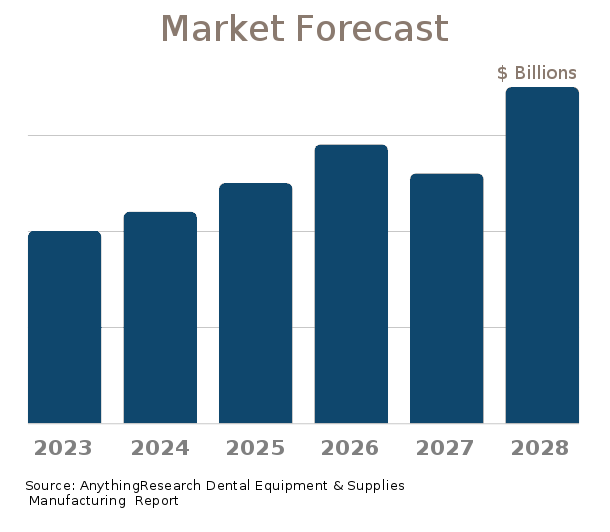

2022-2027 Market Forecast

Dental Equipment & Supplies Manufacturing| Market Forecast | Full Report | |

|---|---|---|

| Current State of the Industry |  |

|

| Market Forecast (2022-2027) |  |

|

| Market Size (2017-2021) |  |

|

| Market Landscape - Leading & Disruptive Companies |  |

|

| Innovation News |  |

|

| Products/Services Breakdown |  |

|

| Market Size - per State |  |

|

| Financial Metrics |  |

|

| Salary & Compensation Statistics |  |

|

| Key Companies |  |

|

| Government Vendors |  |

|

| Instant Download - Available immediately upon purchase |  |

|

| Download now: |

2022-2027 Dental Equipment & Supplies Manufacturing Market Forecast

U.S. Market Forecast & Outlook

Forecasting the trends in the market size for the Dental Equipment & Supplies Manufacturing industry is a necessary part of the business planning process. AnythingResearch forecasts are used by- Financial institutions seeking to understand credit-worthiness prior to lending

- Investors evaluating startups, venture opportunities, and equities

- Corporations setting strategy and sales & marketing objectives

- Startups demonstrating the "market opportunity" for their business

| Forecast / Industry Outlook | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

|---|---|---|---|---|---|---|

| Market Forecast ($ millions) | ||||||

| Projected Industry Growth Rate (%) | ||||||

The future growth of the Dental Equipment & Supplies Manufacturing is influenced by internal and external factors. Internal factors include structure and competition within the industry, market demand, and innovative and disruptive factors. External factors include the state of the economy and cyclical patterns.

Dental Equipment & Supplies Manufacturing Competitor Landscape & Key Companies [PREMIUM]

The most influential companies in the Dental Equipment & Supplies Manufacturing industry and adjacent industries either have large market share or are developing new business models and methods that could disrupt the status quo. We look at leading and emerging companies in the Dental Equipment & Supplies Manufacturing industry and adjacent sectors:| Market Leaders: Direct Competitors Companies with the largest market share, focused in this industry |

Market leaders: Diversified Competitors Largest companies that have diversified operations in this and other industries |

| Innovators: Direct Competitors Innovative, Emerging, and Disruptive Companies that may influence the future direction of the industry. |

Innovators: Diversified Competitors Innovators and Disruptors in adjacent industries that may also affect the Dental Equipment & Supplies Manufacturing industry. |

Source:

Innovation News

- Apteryx trademarks "APTERYX IMAGING" - computer software for use in image acquisition and processing, data transmission, data encryption and decryption, for accessing networked computers, database management and inventory management; x-ray imaging sensors; computer hardware - 10/07/2019

- Apteryx trademarks "APTERYX IMAGING" - computer software for use in image acquisition and processing, data transmission, data encryption and decryption, for accessing networked computers, database management and inventory management; x-ray imaging sensors; computer hardware - 10/07/2019

- Apteryx trademarks "APTERYX" - image acquisition hardware; x-ray imaging sensors; computer hardware - 06/17/2019

- Apteryx patents System And Method To Capture An Image Over The Web - 08/13/2015

- Apteryx patents System And Method To Capture An Image Over The Web - 08/13/2015

- Apteryx patents Real-time Application Of Filters Based On Image Attributes - 12/20/2012

Executive Briefings

program.Through our internal research centers as well as through our collaborations with external research institutions, dental and medical schools, the Company directly invests in the development of new products, the improvement of existing products and advancements in technology. These investments include an emphasis on research in digital data sharing technology, including the incorporation of long-term artificial intelligence and machine learning. The continued development of these areas is a critical step in meeting the Companyâs strategic goal to be a leader in defining the future of dentistry and preparing the next generation of dental practitioners.Operating and Technical ExpertiseDentsply Sirona believes that its manufacturing capabilities are important to its success. The manufacturing processes of the Companyâs products require substantial and varied technical expertise. Complex materials technology and processes are necessary to manufacture the Companyâs products. The Company endeavors to automate its global manufacturing operations in the interest of improving product quality and lowering costs.FinancingInformation about Dentsply Sironaâs working capital, liquidity and capital resources is provided in Part II, Item 7 âManagementâs Discussion and Analysis of Financial Condition and Results of Operationsâ of this Form 10-K.CompetitionThe Company conducts its global operations, under highly competitive market conditions. Competition in the industries for dental technology and equipment, dental consumables, and continence care products is based primarily upon product performance, quality, safety and ease of use, as well as price, customer service, innovation and acceptance by clinicians, technicians and patients. Dentsply Sirona believes that its principal strengths include its well-established brand names, its end-to-end dental portfolio, its reputation for high quality and innovative products, its leadership in product development and manufacturing, its global sales force, the breadth of its distribution network, its commitment to customer satisfaction and support of the Companyâs products by dental and medical professionals.The size and number of the Companyâs competitors vary by product line and from region to region. There are many companies that produce some of the same types of products as those produced by the Company, but no single competitor produces the breadth of products that are produced by the Company.9Regulation The development, manufacture, sales and distribution of the Companyâs products are subject to comprehensive governmental regulation both within and outside the United States. The following sections describe some, but not all, of the significant regulations that apply to the Company. For a description of the risks related to the regulations that the Company is subject to, please refer to Item 1A, âRisk Factors,â of this Form 10-K. The majority of the Companyâs products are classified as medical devices and are subject to restrictions under domestic and foreign laws, rules, regulations, self-regulatory codes, circulars and orders, including, but not limited to, the U.S. countries in which they are produced or sold.Dental and medical devices sold by the Company in the United States are generally classified by the FDA into a category that renders them subject to the same controls that apply to all medical devices, including regulations regarding alteration, misbranding, notification, record-keeping and good manufacturing practices. In the EU, the Companyâs products are subject to the medical device laws of the various member states, which are based on a Directive of the European Commission. The Companyâs products in Europe bear the CE mark showing that such products comply with European regulations. The Companyâs products classified by the EU MDD were mandated to be certified under the new MDR. These regulations also applied to all medical device manufacturers who market their medical devices in the EU and all such manufacturers had to perform significant upgrades to quality systems and processes including technical documentation and subject them to new certification under the EU MDR in order to continue to sell those products in the EU. This also includes completion of certified quality management systems by May 26, 2024. The Company remains focused on ensuring that all its products that are considered to be medical devices will be fully certified as required by the EU MDR dates and timelines. Beginning in late 2022, the Chinese government launched a national program for volume-based, centralized medical device and consumables procurement with minimum quantity commitments in an attempt to negotiate lower prices from drug manufacturers and reduce the price of medical devices and other products. Under the program, the government will award contracts to the lowest bidders who are able to satisfy the quality and quantity requirements. The successful bidders will be guaranteed a sales volume for at least a year, giving the winner an opportunity to gain or increase market share. The volume guarantee is intended to make manufacturers more willing to cut their prices in order to win a bid and may also enable successful bidders to lower their distribution and commercial costs. The program, which took effect in the first half of 2023, resulted in a temporary reduction in net sales of our implants products during that period due to reduced prices, which was offset by higher volume of net sales in the second half of 2023. Future expansion of the program by the Chinese government could result in reduced margins on covered devices and products, required renegotiation of distributor arrangements, and incurrence of inventory-related charges.The Company is also subject to domestic and foreign laws, rules, regulations, self-regulatory codes, circulars and orders regarding anti-bribery and anti-corruption, including, but not limited to, the U.S. Federal Anti-Kickback Statute (âAKSâ), the UKâs Bribery Act 2010 (c.23), Brazilâs Clean Company Act 2014 (Law No. jurisdictions generally prohibit companies and their intermediaries from improperly offering or paying anything of value to foreign government officials for the purpose of obtaining or retaining business. Some of the Companyâs customer relationships are with governmental entities and therefore may be subject to such anti-bribery laws. 10The Companyâs production and sales of products is further subject to regulations concerning the supply of conflict minerals, various environmental regulations such as the Federal Water Pollution Control Act (the âClean Water Actâ) and others enforced by the Environmental Protection Agency (âEPAâ) or equivalent state agencies, and the Patient Protection and Affordable Care Act as amended by the Health Care and Education Reconciliation Act (the âHealth Care Reform Lawâ). In the sale, delivery and servicing of the Companyâs products to other countries, it must also comply with various domestic and foreign export control and trade embargo laws and regulations, including those administered by the Department of Treasuryâs Office of Foreign Assets Control (âOFACâ), the Department of Commerceâs Bureau of Industry and Security (âBISâ) and similar international governmental agencies, which may require licenses or other authorizations for transactions relating to certain countries and/or with certain individuals identified by the respective government. Despite the Companyâs internal compliance program, policies and procedures may not always protect it from reckless or criminal acts committed by its employees or agents. Due in part to its direct-to-consumer model, the Companyâs Byte aligner business in the United States is subject to various state laws, rules and policies which govern the practice of dentistry within such state. Byte contracts with an expansive nationwide network of independent licensed dentists and orthodontists for the provision of clinical services, including the oversight and control of each customerâs clinical treatment in order to comply with these regulations and ensure that the business does not violate rules pertaining to the corporate practice of dentistry.The Company is subject to domestic and foreign laws, rules, regulations, self-regulatory codes, circulars and orders governing data privacy and transparency, including, but not limited to, the Health Insurance Portability and Accountability Act of 1996 (âHIPAAâ) as amended by the Health Information Technology for Economic and Clinical Health Act of 2009 (the âHITECH Actâ), the California Consumer Privacy Act, the European General Data Protection Regulation (the âGDPRâ), Chinaâs Personal Information Protection Law, the Physician Payments Sunshine Provisions of the Patient Protection and Affordable Care Act, EU Directive 2002/58/EC (and implementing and local measures adopted thereunder), Franceâs Data Protection Act of 1978 (rev. The Physician Payments Sunshine Provisions of the Patient Protection and Affordable Care Act require the Company to record all transfers of value to physicians and teaching hospitals and to report this data to the Centers for Medicare and Medicaid Services for public disclosure. Similar reporting requirements have also been enacted in several states, and an increasing number of countries worldwide either have adopted or are considering similar laws requiring transparency of interactions with health care professionals.The Company believes it is in substantial compliance with the laws and regulations that regulate its business. See Item 1A, âRisk Factors,â of this Form 10-K for additional detail.Sources and Supply of Raw Materials and Finished GoodsThe Company manufactures the majority of the products that it sells. The Company sources the necessary raw materials from various suppliers, and no single supplier accounts for more than 10% of our supply requirements.Intellectual PropertyProducts manufactured by Dentsply Sirona are sold primarily under its own tradenames and trademarks. Dentsply Sirona also owns and maintains more than 5,000 patents throughout the world and has also licensed a number of patents owned by others.Our policy is to protect its products and technology through patents and trademark registrations both in the United States and in significant international markets. The Company monitors trademark use worldwide and promotes enforcement of its patents and trademarks in a manner that is designed to balance the cost of such protection against obtaining the greatest value for the Company. Dentsply Sirona believes its patents and trademark properties are important and contribute to the Companyâs marketing position but it does not consider its overall business to be materially dependent upon any individual patent or trademark. Additional information regarding certain risks related to our intellectual property is included in Item 1A âRisk Factorsâ of this Form 10-K and is incorporated herein by reference.11Human CapitalOur employees are core to our Company, and their contributions enable the success of our business. We strive to foster a diverse and inclusive environment where every employee can grow and perform at their best.Attract, Engage, Develop Dentsply Sirona

Related Reports

Can't find what you're looking for? We have over a thousand

market research reports.

Ask us and an analyst will help you find what you need.