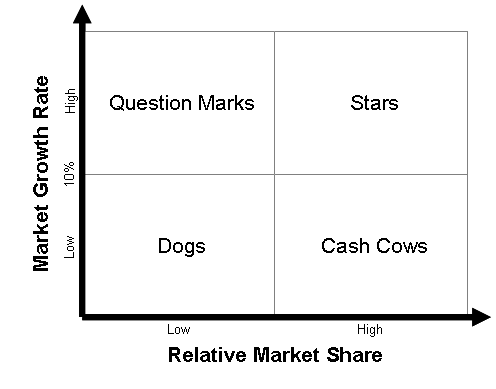

Strategic Planning with the BCG Growth-Share Matrix Framework

BCG Growth-Share Matrix is a technique that enables better strategic planning in business.

The Growth-Share matrix is a tool to prioritize products or business lines based on their relative market share and growth rate.

Each business unit (or products) is plotted on a scatter graph on the basis of their relative

market shares and growth rates.

Each business unit (or products) is plotted on a scatter graph on the basis of their relative

market shares and growth rates.

- Cash cows are units with high market share in a slow-growing industry. These units typically generate cash in excess of the amount of cash needed to maintain the business. They are regarded as staid and boring, in a mature market, and every corporation would be thrilled to own as many as possible. They are to be milked continuously with as little investment as possible, since such investment would be wasted in an industry with low growth.

- Dogs are units with low market share in a mature, slow-growing industry. These units typically break even, generating barely enough cash to maintain the business's market share. Though owning a break-even unit provides the social benefit of providing jobs and possible synergies that assist other business units, from an accounting point of view such a unit is worthless, not generating cash for the company. They depress a profitable company's return on assets ratio, used by many investors to judge how well a company is being managed. Dogs, it is thought, should be sold off.

- Question marks (also known as problem child) are growing rapidly and thus consume large amounts of cash, but because they have low market shares they do not generate much cash. The result is a large net cash consumption. A question mark has the potential to gain market share and become a star, and eventually a cash cow when the market growth slows. If the question mark does not succeed in becoming the market leader, then after perhaps years of cash consumption it will degenerate into a dog when the market growth declines. Question marks must be analyzed carefully in order to determine whether they are worth the investment required to grow market share.

- Stars are units with a high market share in a fast-growing industry. The hope is that stars become the next cash cows. Sustaining the business unit's market leadership may require extra cash, but this is worthwhile if that's what it takes for the unit to remain a leader. When growth slows, stars become cash cows if they have been able to maintain their category leadership, or they move from brief stardom to dogdom.[citation needed]

As a particular industry matures and its growth slows, all business units become either cash cows or dogs. The natural cycle for most business units is that they start as question marks, then turn into stars. Eventually the market stops growing thus the business unit becomes a cash cow. At the end of the cycle the cash cow turns into a dog.

The overall goal of this ranking was to help corporate analysts decide which of their business units to fund, and how much; and which units to sell. A diversified company with a balanced portfolio can use its strengths to truly capitalize on its growth opportunities. The balanced portfolio has:

- stars whose high share and high growth assure the future;

- cash cows that supply funds for that future growth; and

- question marks to be converted into stars with the added funds.

Other Strategic Planning Frameworks

- 4P's Marketing Mix

- Seven S (7S) Management Framework

- AIDA - Attention, Interest, Desire, Action - Buying Process

- Ansoff's Matrix - Product-Market Growth Matrix - Expansion Strategy

- BCG Growth-Share Matrix

- Bass Diffusion Model - Product Adoption and Innovation

- Blue Ocean Strategy

- Choice Model for Decision-Making Behavior

- Competitive Advantage

- Core Competence - Collective Learning in the Organization

- Cost-Benefit Analysis

- Delta Model

- ERG (Existence, Relatedness, Growth) Theory of Motivation

- Experience Curve

- Framing Effect on Psychology and Marketing

- GE (McKinsey) Matrix

- Growth Phases

- Predicting Industry Evolution and Change

- OODA Loop - Observe, Orient, Decide, Act

- PDCA (Plan, Do, Check, Act) - The Deming Cycle

- PEST Analysis - Political, Economical, Social, Technological, Environmental, and Legal Factors

- Perceptual Mapping - Brand Marketing

- Porter's Five Forces

- Product and Marketing Positioning

- Product Lifecycle (Industry Lifecycle)

- Root Cause Analysis

- SWOT Analysis - Strengths, Weaknesses, Opportunties, Threats

- Technology Adoption Curve

- Value Chain

- Balanced Scorecard

- Benchmarking

- Customer Segmentation

- Pricing Strategy & Price Optimization

- Mergers and Acquisitions (M&A)

SATISFACTION GUARANTEE

We have helped thousands of businesses with their research, and we are confident we can help you, too. We offer a 7-Day Money Back Guarantee on all purchases.