Securities, Commodity Contracts, and Other Financial Investments Industry Trends

March 2026

March 2026

Trend Report Overview - Securities, Commodity Contracts, and Other Financial Investments

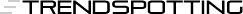

The Trend Spotting report is a monthly supplement to the Industry Research Report on Securities, Commodity Contracts, and Other Financial Investments that shows current market and employment trends. This report helps identify upward and downard swings in the Securities, Commodity Contracts, and Other Financial Investments market as they are occurring.Price Trends for Securities, Commodity Contracts, and Other Financial Investments

This section shows how prices are changing within the on a month-to-month basis. Price changes may be affected by seasonal demand, or by larger movements in the market.

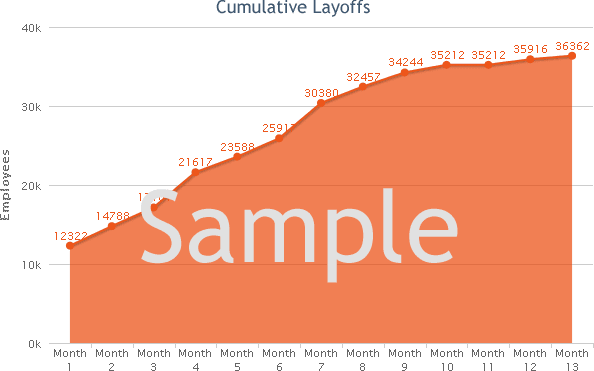

Sector Layoff Trends for Securities, Commodity Contracts, and Other Financial Investments

This section shows how layoffs are affecting the overall sector. This includes both the Securities, Commodity Contracts, and Other Financial Investments industry as well as adjacent markets that employ a similar workforce. Layoffs are both a warning symbol, as well as an opportunity. Understand what's happening in the market in recent months is critical to making informed business decisions.

Determine whether customer demand is ticking upwards, or shifting in the reverse direction. What the trend in Securities, Commodity Contracts, and Other Financial Investments shows about sales over the course of the year demonstrates how busineses should react. Find new trends, the latest trends, and current trends. The newest markets indicators show declining and growth prospects, as well as historical data. Market trends and industry trends for Securities, Commodity Contracts, and Other Financial Investments show what's what. Companies that react to trends faster than the competition can achieve outstanding results and jump ahead of the market. Employers reduce workforce through layoffs because of a fragile economy, soft demand, or financial pressure. Our lab monitors the latest news and events to give updated statistics.