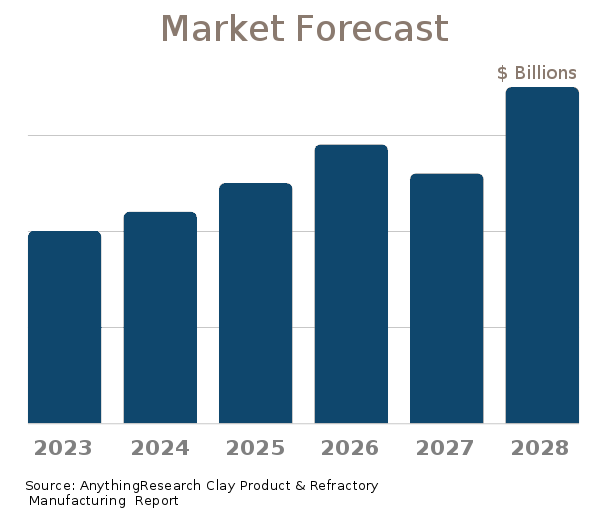

2022-2027 Market Forecast

Clay Product & Refractory Manufacturing| Market Forecast | Full Report | |

|---|---|---|

| Current State of the Industry |  |

|

| Market Forecast (2022-2027) |  |

|

| Market Size (2017-2021) |  |

|

| Market Landscape - Leading & Disruptive Companies |  |

|

| Innovation News |  |

|

| Products/Services Breakdown |  |

|

| Market Size - per State |  |

|

| Financial Metrics |  |

|

| Salary & Compensation Statistics |  |

|

| Key Companies |  |

|

| Government Vendors |  |

|

| Instant Download - Available immediately upon purchase |  |

|

| Download now: |

2022-2027 Clay Product & Refractory Manufacturing Market Forecast

U.S. Market Forecast & Outlook

Forecasting the trends in the market size for the Clay Product & Refractory Manufacturing industry is a necessary part of the business planning process. AnythingResearch forecasts are used by- Financial institutions seeking to understand credit-worthiness prior to lending

- Investors evaluating startups, venture opportunities, and equities

- Corporations setting strategy and sales & marketing objectives

- Startups demonstrating the "market opportunity" for their business

| Forecast / Industry Outlook | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

|---|---|---|---|---|---|---|

| Market Forecast ($ millions) | ||||||

| Projected Industry Growth Rate (%) | ||||||

The future growth of the Clay Product & Refractory Manufacturing is influenced by internal and external factors. Internal factors include structure and competition within the industry, market demand, and innovative and disruptive factors. External factors include the state of the economy and cyclical patterns.

Clay Product & Refractory Manufacturing Competitor Landscape & Key Companies [PREMIUM]

The most influential companies in the Clay Product & Refractory Manufacturing industry and adjacent industries either have large market share or are developing new business models and methods that could disrupt the status quo. We look at leading and emerging companies in the Clay Product & Refractory Manufacturing industry and adjacent sectors:| Market Leaders: Direct Competitors Companies with the largest market share, focused in this industry |

Market leaders: Diversified Competitors Largest companies that have diversified operations in this and other industries |

| Innovators: Direct Competitors Innovative, Emerging, and Disruptive Companies that may influence the future direction of the industry. |

Innovators: Diversified Competitors Innovators and Disruptors in adjacent industries that may also affect the Clay Product & Refractory Manufacturing industry. |

Source:

Innovation News

- AS America patents Flush Toilet - 07/14/2022

- AS America patents Flush Toilet - 07/14/2022

- Carbo Ceramics patents Composition And Method For Hydraulic Fracturing And Evaluation And Diagnostics Of Hydraulic Fractures Using Infused Porous Ceramic Proppant - 07/07/2022

- Wonder Porcelain Group trademarks "SONORAN PLATEAU PORCELAIN" - Non-metal porcelain tiles for floors and walls - 04/11/2022

- Wonder Porcelain Group trademarks "DESTINY SLATE PORCELAIN" - Non-metal porcelain tiles for floors and walls - 12/03/2021

- Wonder Porcelain Group trademarks "MILLENNIUM PORCELAIN" - Non-metal porcelain tiles for floors and walls - 12/03/2021

- Clay raises $1 million in funding. - 06/15/2021

- Clay raises $3 million in funding. - 06/15/2021

- Fireclay Tile raises $1 million in funding. - 08/30/2017

Executive Briefings

As the demand for ceramic proppant (including proppant produced by us) continued to be negatively impacted in 2019 and continuing into 2020, the number of domestic and international competitors in the marketplace continued to decrease, and many of our competitors have shut down plants and/or reduced production.  However, we do not have full visibility as to the extent or duration of 4  these shut-downs and reductions.  One of our worldwide proppant competitors is Saint-Gobain Proppants (âSaint-Gobainâ).  Saint-Gobain is a division of Compagnie de Saint-Gobain, a large French glass and materials company.  Saint-Gobain manufactures a variety of ceramic proppants that it markets in competition with some of our products.  Saint-Gobainâs primary manufacturing facilities are located in Bauxite, Arkansas.  Saint-Gobain also manufactures ceramic proppant in China.  Mineracao Curimbaba (âCurimbabaâ), based in Brazil, also manufactures and markets ceramic proppant in competition with some of our products.  Imerys, S.A., a competitor based in France (âImerysâ), has ceramic proppant manufacturing facilities in Andersonville and Wrens, Georgia and also competes with some of our products.  Imerys sold their Wrens, Georgia proppant manufacturing facility to a third party in 2019. We are aware of a number of manufacturers in China.  Most of these companies produce intermediate-density and low-density ceramic proppants that are marketed both inside and outside of China.  However, beginning in early 2015, imports into North America declined significantly or stopped. Our KRYPTOSPHERE product line replaced both CARBOHSP and CARBOPROP.  Historically, competition for CARBOHSP and CARBOPROP principally includes ceramic proppant manufactured by Saint-Gobain, Curimbaba, as well as various manufacturers located in China.  Our CARBOLITE, CARBOECONOPROP and CARBOHYDROPROP products compete primarily with ceramic proppant produced by Saint-Gobain, Curimbaba and Imerys and with sand-based proppant for use in the hydraulic fracturing of natural gas and oil wells.  At this time, there is not in our view a comparable competitorâs product to our mono-mesh KRYPTOSPHERE product line, which is the subject of patent protection. We believe that some of the significant factors that influence a customerâs decision to purchase our ceramic proppant are (i) reservoir and geological characteristics, (ii) price/performance ratio, (iii) on-time delivery performance, (iv) technical support, (v) proppant availability and (vi) the financial status of E Carbo Ceramics

Related Reports

Can't find what you're looking for? We have over a thousand

market research reports.

Ask us and an analyst will help you find what you need.