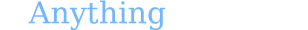

2022-2027 Market Forecast

Professional & Commercial Equipment & Supplies Merchant Wholesalers| Market Forecast | Full Report | |

|---|---|---|

| Current State of the Industry |  |

|

| Market Forecast (2022-2027) |  |

|

| Market Size (2017-2021) |  |

|

| Market Landscape - Leading & Disruptive Companies |  |

|

| Innovation News |  |

|

| Products/Services Breakdown |  |

|

| Market Size - per State |  |

|

| Financial Metrics |  |

|

| Salary & Compensation Statistics |  |

|

| Key Companies |  |

|

| Government Vendors |  |

|

| Instant Download - Available immediately upon purchase |  |

|

| Download now: |

2022-2027 Professional & Commercial Equipment & Supplies Merchant Wholesalers Market Forecast

U.S. Market Forecast & Outlook

Forecasting the trends in the market size for the Professional & Commercial Equipment & Supplies Merchant Wholesalers industry is a necessary part of the business planning process. AnythingResearch forecasts are used by- Financial institutions seeking to understand credit-worthiness prior to lending

- Investors evaluating startups, venture opportunities, and equities

- Corporations setting strategy and sales & marketing objectives

- Startups demonstrating the "market opportunity" for their business

| Forecast / Industry Outlook | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

|---|---|---|---|---|---|---|

| Market Forecast ($ millions) | ||||||

| Projected Industry Growth Rate (%) | ||||||

The future growth of the Professional & Commercial Equipment & Supplies Merchant Wholesalers is influenced by internal and external factors. Internal factors include structure and competition within the industry, market demand, and innovative and disruptive factors. External factors include the state of the economy and cyclical patterns.

Professional & Commercial Equipment & Supplies Merchant Wholesalers Competitor Landscape & Key Companies [PREMIUM]

The most influential companies in the Professional & Commercial Equipment & Supplies Merchant Wholesalers industry and adjacent industries either have large market share or are developing new business models and methods that could disrupt the status quo. We look at leading and emerging companies in the Professional & Commercial Equipment & Supplies Merchant Wholesalers industry and adjacent sectors:| Market Leaders: Direct Competitors Companies with the largest market share, focused in this industry |

Market leaders: Diversified Competitors Largest companies that have diversified operations in this and other industries |

| Innovators: Direct Competitors Innovative, Emerging, and Disruptive Companies that may influence the future direction of the industry. |

Innovators: Diversified Competitors Innovators and Disruptors in adjacent industries that may also affect the Professional & Commercial Equipment & Supplies Merchant Wholesalers industry. |

Source:

Innovation News

- Thorwear raises $3 million in funding. - 01/30/2024

- Brindlee Mountain Fire Apparatus raises $7 million in funding. - 07/12/2023

- Valet Energy raises $1 million in funding. - 06/30/2023

- Elite Screens trademarks "EPV PROJECTION SCREENS" - Projection screens - 07/22/2022

- Global Memory Procurement trademarks "EVERYTHING EVERYWHERE" - On-line retail store services featuring memory cards - 07/18/2022

- Global Memory Procurement trademarks "EVERYTHING IT EVERYWHERE" - On-line retail store services featuring memory cards - 07/18/2022

- Noctrix Health patents Variable Operating Point Neural Electrostimulation Such As To Treat Rls - 07/14/2022

- Peak Design patents Mobile Device Mounting System - 07/07/2022

- Industrial Security Solutions patents Novel Smart Anti-theft Tag With Quadruple Alarm Function - 06/30/2022

Executive Briefings

The medical products industry is highly competitive. Many of our competitors are much larger than we are and have access to greater resources. We also compete with smaller companies that sell single or limited numbers of products in specific product lines or geographies. We compete globally in several market areas, including radiology; diagnostic and interventional cardiology; interventional radiology; neurointerventional radiology; vascular, general and thoracic surgery; electrophysiology; cardiac rhythm management; interventional pulmonology; interventional nephrology; orthopedic spine surgery; interventional oncology; pain management; outpatient access centers; intensive care; computed tomography; ultrasound; and interventional gastroenterology.The principal competitive factors in the markets in which our products are sold are quality, price, product features, customer service, breadth of line, and customer relationships. We believe our products are attractive to customers due to their innovative designs, the quality of materials and workmanship, clinical performance, our strong focus on customer needs, and our prompt attention to customer requests. As a company, some of our primary competitive strengths are our relative stability in the marketplace; comprehensive, broad line of ancillary products; manufacturing integration to secure our supply chain; and strong cadence of new products and product line extensions that enhance our portfolio.Our primary competitors in our peripheral intervention market are Teleflex Incorporated (âTeleflexâ), Cook Medical Incorporated (âCook Medicalâ), Medtronic plc (âMedtronicâ), Boston Scientific Corporation (âBoston Scientificâ), and Becton, Dickinson and Company (âBDâ). Our primary competitors in our cardiac intervention market are BD, Teleflex, Medtronic, Abbott Laboratories, Terumo Corporation, Edwards Lifesciences Corporation, Cook Medical, and Boston Scientific. Our primary competitors in our spine market are Medtronic, Stryker Corporation, and Johnson Merit Medical Systems

Related Reports

Can't find what you're looking for? We have over a thousand

market research reports.

Ask us and an analyst will help you find what you need.