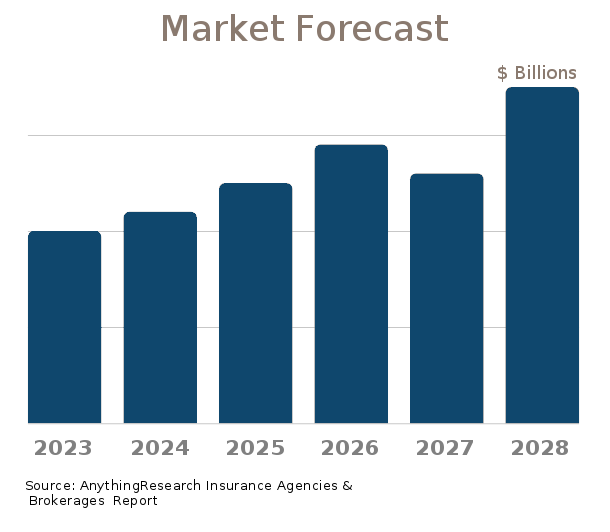

2022-2027 Market Forecast

Insurance Agencies & Brokerages| Market Forecast | Full Report | |

|---|---|---|

| Current State of the Industry |  |

|

| Market Forecast (2022-2027) |  |

|

| Market Size (2017-2021) |  |

|

| Market Landscape - Leading & Disruptive Companies |  |

|

| Innovation News |  |

|

| Products/Services Breakdown |  |

|

| Market Size - per State |  |

|

| Financial Metrics |  |

|

| Salary & Compensation Statistics |  |

|

| Key Companies |  |

|

| Government Vendors |  |

|

| Instant Download - Available immediately upon purchase |  |

|

| Download now: |

2022-2027 Insurance Agencies & Brokerages Market Forecast

U.S. Market Forecast & Outlook

Forecasting the trends in the market size for the Insurance Agencies & Brokerages industry is a necessary part of the business planning process. AnythingResearch forecasts are used by- Financial institutions seeking to understand credit-worthiness prior to lending

- Investors evaluating startups, venture opportunities, and equities

- Corporations setting strategy and sales & marketing objectives

- Startups demonstrating the "market opportunity" for their business

| Forecast / Industry Outlook | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

|---|---|---|---|---|---|---|

| Market Forecast ($ millions) | ||||||

| Projected Industry Growth Rate (%) | ||||||

The future growth of the Insurance Agencies & Brokerages is influenced by internal and external factors. Internal factors include structure and competition within the industry, market demand, and innovative and disruptive factors. External factors include the state of the economy and cyclical patterns.

Insurance Agencies & Brokerages Competitor Landscape & Key Companies [PREMIUM]

The most influential companies in the Insurance Agencies & Brokerages industry and adjacent industries either have large market share or are developing new business models and methods that could disrupt the status quo. We look at leading and emerging companies in the Insurance Agencies & Brokerages industry and adjacent sectors:| Market Leaders: Direct Competitors Companies with the largest market share, focused in this industry |

Market leaders: Diversified Competitors Largest companies that have diversified operations in this and other industries |

| Innovators: Direct Competitors Innovative, Emerging, and Disruptive Companies that may influence the future direction of the industry. |

Innovators: Diversified Competitors Innovators and Disruptors in adjacent industries that may also affect the Insurance Agencies & Brokerages industry. |

Source:

Innovation News

- Leveragerx raises $3 million in funding. - 06/14/2023

- Insight Catastrophe Group raises $240 million in funding. - 05/30/2023

- Nexben raises $28 million in funding. - 05/08/2023

- Great Point Insurance Services trademarks "JETPRO INSURANCE" - Rendering brokerage, underwriting, issuance and administration of insurance to other insurance producers; acting as an insurance producer, general agent, managing agent or broker between one or more insurers and other insurance producers; and representing one or more insureds as an insurance producer, general agent, managing agent or broker with authority to appoint sub-agents, all of the foregoing for jets - 07/23/2022

- Aera Technology trademarks "AERA DECISION CLOUD" - Downloadable software for enterprise-wide activities, to manage transactional data, provide statistical analysis, and produce notifications, reports, and produce or initiate actions into Enterprise Resource Planning systems and other connected software systems; providing temporary use of online, non-downloadable software that provides real-time, integrated business planning, management and intelligence by combining information from various databases and presenting it in an easy-to-understand user interface; providing temporary use of online, non-downloadable software that provides data analytics for purposes of optimizing enterprise wide performance; providing temporary use of online, non-downloadable software that provides data analytics for purposes of automating decisions and actions to improve enterprise wide performance; providing temporary use of online, non-downloadable software that provides data analytics for purposes of providing real-time, autonomous recommendations based on machine learning and artificial intelligence to improve and optimize enterprise wide performance - 07/21/2022

- Aera Technology trademarks "AERA DECISION CLOUD" - Providing temporary use of on-line non-downloadable software for analyzing data; providing temporary use of online, non-downloadable software for accessing information directories; providing temporary use of online, non-downloadable software for creating searchable databases of information and data; providing temporary use of online, non-downloadable software for enterprise-wide activities, to manage transactional data, provide statistical analysis, and produce notifications, reports, and produce or initiate actions into Enterprise Resource Planning systems and other connected software systems; providing temporary use of online, non-downloadable software that provides real-time, integrated business planning, management and intelligence by combining information from various databases and presenting it in an easy-to-understand user interface; providing temporary use of online, non-downloadable software that provides data analytics for purposes of optimizing enterprise wide performance; providing temporary use of online, non-downloadable software that provides data analytics for purposes of automating decisions and actions to improve enterprise wide performance; providing temporary use of online, non-downloadable software that provides data analytics for purposes of providing real-time, autonomous recommendations based on machine learning and artificial intelligence to improve and optimize enterprise wide performance - 07/21/2022

- Insurance Services Office patents Computer Vision Systems And Methods For Determining Roof Conditions From Imagery Using Segmentation Networks - 07/07/2022

- Insurance Services Office patents Computer Vision Systems And Methods For Determining Roof Conditions From Imagery Using Segmentation Networks - 07/07/2022

- Hartford Fire Insurance patents System Tand Method Using Third-party Data To Provide Risk Relationship Adjustment Recommendation Based On Upcoming Life Event - 06/30/2022

Executive Briefings

The market for agricultural productivity traits is highly competitive, and Cibus faces significant competition. The development of productivity traits are the primary target of plant breeding programs and a key basis of competition in the âseed and traitâ business. These technologies underpin the expected performance of a given seed and are the primary basis for competition in the seed business. These technologies are generally developed internally by seed companies, but they are often bought or licensed from third parties such as other seed companies, the many academic institutions that have large programs, or independent trait developers. The most likely competitors are likely to come from a relatively small number of major global agricultural chemical companies, including BASF, Bayer, - 21 - Corteva AgriScience, and Syngenta, smaller biotechnology research companies and institutions, including Arcadia Biosciences, Benson Hill Biosystems, Inari Agriculture, KeyGene, Pairwise Plants, Precision BioSciences now Elo Life Systems, Yield10, and academic institutions. The Company's major competitors in some instances may also be its customers. Many of the companies above license out traits they have developed but sometimes they retain the rights for both competitive reasons and technical reasons.Many of Cibusâ current or potential competitors, either alone or with their R Minnesota Life Insurance

Related Reports

Can't find what you're looking for? We have over a thousand

market research reports.

Ask us and an analyst will help you find what you need.