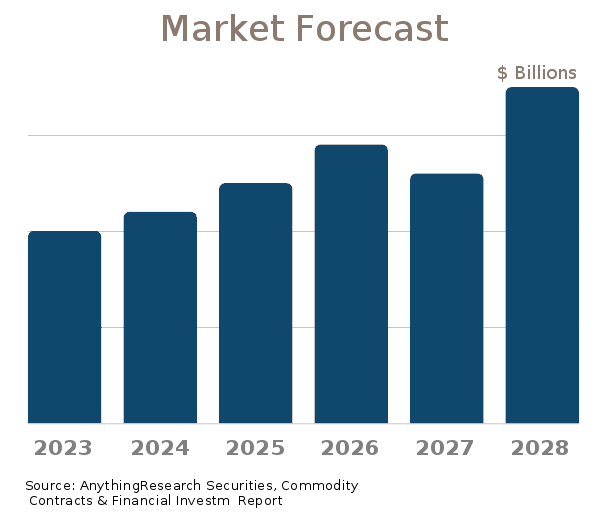

2022-2027 Market Forecast

Securities, Commodity Contracts & Financial Investments| Market Forecast | Full Report | |

|---|---|---|

| Current State of the Industry |  |

|

| Market Forecast (2022-2027) |  |

|

| Market Size (2017-2021) |  |

|

| Market Landscape - Leading & Disruptive Companies |  |

|

| Innovation News |  |

|

| Products/Services Breakdown |  |

|

| Market Size - per State |  |

|

| Financial Metrics |  |

|

| Salary & Compensation Statistics |  |

|

| Key Companies |  |

|

| Government Vendors |  |

|

| Instant Download - Available immediately upon purchase |  |

|

| Download now: |

2022-2027 Securities, Commodity Contracts & Financial Investments Market Forecast

U.S. Market Forecast & Outlook

Forecasting the trends in the market size for the Securities, Commodity Contracts & Financial Investments industry is a necessary part of the business planning process. AnythingResearch forecasts are used by- Financial institutions seeking to understand credit-worthiness prior to lending

- Investors evaluating startups, venture opportunities, and equities

- Corporations setting strategy and sales & marketing objectives

- Startups demonstrating the "market opportunity" for their business

| Forecast / Industry Outlook | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

|---|---|---|---|---|---|---|

| Market Forecast ($ millions) | ||||||

| Projected Industry Growth Rate (%) | ||||||

The future growth of the Securities, Commodity Contracts & Financial Investments is influenced by internal and external factors. Internal factors include structure and competition within the industry, market demand, and innovative and disruptive factors. External factors include the state of the economy and cyclical patterns.

Securities, Commodity Contracts & Financial Investments Competitor Landscape & Key Companies [PREMIUM]

The most influential companies in the Securities, Commodity Contracts & Financial Investments industry and adjacent industries either have large market share or are developing new business models and methods that could disrupt the status quo. We look at leading and emerging companies in the Securities, Commodity Contracts & Financial Investments industry and adjacent sectors:| Market Leaders: Direct Competitors Companies with the largest market share, focused in this industry |

Market leaders: Diversified Competitors Largest companies that have diversified operations in this and other industries |

| Innovators: Direct Competitors Innovative, Emerging, and Disruptive Companies that may influence the future direction of the industry. |

Innovators: Diversified Competitors Innovators and Disruptors in adjacent industries that may also affect the Securities, Commodity Contracts & Financial Investments industry. |

Source:

Innovation News

- Karner Blue Capital raises $2 million in funding. - 08/02/2023

- Cordillera GSC Co-Investment II raises $40 million in funding. - 07/31/2023

- Cordillera GSC Co-Investment II raises $403 million in funding. - 07/31/2023

- Balentine trademarks "A WEALTH OF PERSPECTIVE" - Financial services - 07/23/2022

- Glen Eagle Advisors trademarks "" - Downloadable computer application software for mobile phones and handheld computers - 07/23/2022

- Glen Eagle Advisors trademarks "ALOOOLA" - Downloadable computer application software for mobile phones and handheld computers - 07/23/2022

- Lone Gull Holdings patents Renewable Energy Device With Lateral Aperture Wave-driven Propulsion - 07/07/2022

- Lone Gull Holdings patents Renewable Energy Device With Lateral Aperture Wave-driven Propulsion - 07/07/2022

- Stockpile patents Systems And Methods For Providing Gift Certificates Of Stock - 07/07/2022

Executive Briefings

We face competition from various entities for investment opportunities in properties, including other REITs, real estate operating companies, pension funds, insurance companies, investment funds and companies, partnerships and developers, some of which are likely a source of reasonable alternatives under Regulation Best Interest. In addition to third-party competitors, other programs sponsored by the Advisor and its affiliates, particularly those with investment strategies that overlap with ours, may seek investment opportunities in accordance with Cohen Cohen & Steers Income Opportunities REIT

Related Reports

Can't find what you're looking for? We have over a thousand

market research reports.

Ask us and an analyst will help you find what you need.